Tuesday, November 30, 2010

TSRID - Just came up on my screen

Special Warning on Micro Cap Stocks - Ultra low float stocks are always risky to enter them late or shorting them too early. You gotta be fast, smart and thoughtful when you deal with these beasts. Finally, tips are mine but risk/reward is yours.

A general Caution and Advise -As I always advise in my posts, Do not chase stocks. please keep in mind that I am not a Stock Market Analyst or an Investment Adviser to count on my recommendations/alerts. As always please do your DD before investing or speculating, start with a small position, always keep your stop losses in place and emotions out. Finally thank me for your profits but do not blame me for your losses because you are the one who pulled the trigger!!!

RITT hit all time high in Pre Market!

I am not recommending this stock to anyone but keep it on your radar and play the game based on your risk appetite.

Good luck to all!

Special Warning on Micro Cap Stocks - Ultra low float stocks are always risky to enter them late or shorting them too early. You gotta be fast, smart and thoughtful when you deal with these beasts. Finally, tips are mine but risk/reward is yours.

A general Caution and Advise -As I always advise in my posts, Do not chase stocks. please keep in mind that I am not a Stock Market Analyst or an Investment Adviser to count on my recommendations/alerts. As always please do your DD before investing or speculating, start with a small position, always keep your stop losses in place and emotions out. Finally thank me for your profits but do not blame me for your losses because you are the one who pulled the trigger!!!

Monday, November 29, 2010

My new Uranium pick - URG

Is IRE the next C or BAC - If you want to some chances, here it is. IRE (Bank of Ireland). Long story short, IRE is the largest Irish bank, which is one amongst the 3 or 4 banks that got bailed out last weekend. Banks got $10 Billion Euros as bailout money and were asked by IMF/EU to utilize their internal resources like Pension funds and other capital sources to recapitalize their banks. This is good news because this path does not lead to nationalizing IRE, which is given some time to raise the funds. The deadline to raise somewhere around 2 Billion EURs is 02-28-2010, which is a good news for both shareholders and bond holders. No haircuts at least for now :) I think IRE is out of the woods for now and I honestly think that it is a safe bet to go long on this stock.

Disclaimer - Long IRE and URG

A general Caution and Advise -As I always advise in my posts, Do not chase stocks. please keep in mind that I am not a Stock Market Analyst or an Investment Adviser to count on my recommendations/alerts. As always please do your DD before investing or speculating, start with a small position, always keep your stop losses in place and emotions out. Finally thank me for your profits but do not blame me for your losses because you are the one who pulled the trigger!!!

Wednesday, November 24, 2010

New picks are here - TIII MITK.OB MTNX

Hope you all are getting ready for thanksgiving with family and friends. I have been recently playing Irish bank stocks, IRE and AIB as swing trades. I am long IRE. It's a high risk/reward play. I am just taking chances hoping that it will turn out to be another C or BAC. I hope I am right!

Here are a few picks that came on my screen and I just put them on my radar last week and I am positive that they could easy double from here.

TIII, MITK.OB, MNTX

TIII - $2.20, Here is its recent 10Q and sexy key stats

MITK.OB - $3.90, Here is its recent earnings. They make mobile apps for smart phones for check deposits, bill payments and other online services. Buy on a pull back.

MNTX - $3.64 - Momentum is going to build. This stock had a decent quarter but the management seems to be too conservative so its little uncomfortable to read too many "SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS" in the report.

Finally VTRO started to move again. It's holiday season and with their new apps in place they are going to get good deal of online pay-per-clicks revenue and new subscribers for alot.com. Short term target is $7.5

That's it for now guys!

Have a great Holiday!

A general Caution and Advise -As I always advise in my posts, Do not chase stocks. please keep in mind that I am not a Stock Market Analyst or an Investment Adviser to count on my recommendations/alerts. As always please do your DD before investing or speculating, start with a small position, always keep your stop losses in place and emotions out. Finally thank me for your profits but do not blame me for your losses because you are the one who pulled the trigger!!!

Friday, November 12, 2010

Great Numbers from OINK!

OINK crushed earnings!!! Here are some 3Q financial highlights --- Revenue was $5.5 million, representing an increase of 76% as compared to the third quarter of 2009

-- Revenue was $15.5 million, an increase of 69% as compared to the first

nine months of 2009

-- Breeder hog revenue increased over 150% while meat hog revenue

increased 38% over the comparable 2009 period. As a result, breeder

revenue comprised 40% of the Company's total revenue during the first

nine months

-- Gross profit more than doubled to $6.7 million with a gross margin of

43.3%, up more than seven percentage points from last year's level

-- Net income was $6.0 million, up 91% from 2009's first nine months

Read the remaining report by clicking here. My boring hog breeder proved to be much much better than that stupid tech stock (MTSL). I am very impressed with this quarter and the 2010 guidance, which says "The Company expects to report full year 2010 revenues of approximately $21 million, net income of $8.1 million to $8.3 million, and EPS of $0.90 to $0.92."

Bottomline - OINK will be a teenager by 4Q.

Good luck guys!

A general Caution and Advise -As I always advise in my posts, Do not chase stocks. please keep in mind that I am not a Stock Market Analyst or an Investment Adviser to count on my recommendations/alerts. As always please do your DD before investing or speculating, start with a small position, always keep your stop losses in place and emotions out. Finally thank me for your profits but do not blame me for your losses because you are the one who pulled the trigger!!!

Thursday, November 11, 2010

MTSL - Not an impressive quarter

OINK is going to release its numbers tomorrow. I sold 90% of my holdings between $7 and $8, which I bought at $3.90. I am still holding a small chunk into the earning tomorrow.

VTRO is doing really well and I am still in it.

A general Caution and Advise -As I always advise in my posts, Do not chase stocks. please keep in mind that I am not a Stock Market Analyst or an Investment Adviser to count on my recommendations/alerts. As always please do your DD before investing or speculating, start with a small position, always keep your stop losses in place and emotions out. Finally thank me for your profits but do not blame me for your losses because you are the one who pulled the trigger!!!

Tuesday, November 9, 2010

WXCO Earnings - Stock up

Uranium stocks that were listed in the previous blog are all up and there is much more upside to those stocks (URRE, UEC, URZ, CCJ, BHP, RIO, SXRZF.PK) but they got to pull back before their next leg up.

MTSL earnings are on 11/11, Thursday so keep it on your watchlist.

OINK earnings are on 11/12, Friday so keep it on your watchlist.

A general Caution and Advise -As I always advise in my posts, Do not chase stocks. please keep in mind that I am not a Stock Market Analyst or an Investment Adviser to count on my recommendations/alerts. As always please do your DD before investing or speculating, start with a small position, always keep your stop losses in place and emotions out. Finally thank me for your profits but do not blame me for your losses because you are the one who pulled the trigger!!!

Monday, November 8, 2010

Let's get some Uranium - Huge upside ahead

"This is a commodity that, when it starts to move, it can get crazy," says Robert Mitchell, general partner of Portal Capital. Uranium is currently trading at $56/pound and is expected to reach $90 in the next 12 months. Uranium stocks are red hot now so better wait for a pull back and take positions. There is certainly a huge opportunity to make some decent money if you follow the industry and its trend.

Here are some stocks which have primary exposure in Uranium and trading at 52 week high - URRE, UEC, URZ, CCJ, BHP, RIO, SXRZF.PK

Disclaimer - I do not have any positions as of today, 11/08/2010 in the above mentioned stocks.

A general Caution and Advise -As I always advise in my posts, Do not chase stocks. please keep in mind that I am not a Stock Market Analyst or an Investment Adviser to count on my recommendations/alerts. As always please do your DD before investing or speculating, start with a small position, always keep your stop losses in place and emotions out. Finally thank me for your profits but do not blame me for your losses because you are the one who pulled the trigger!!!

Friday, November 5, 2010

AMOT - Multibagger

A general Caution and Advise -As I always advise in my posts, Do not chase stocks. please keep in mind that I am not a Stock Market Analyst or an Investment Adviser to count on my recommendations/alerts. As always please do your DD before investing or speculating, start with a small position, always keep your stop losses in place and emotions out. Finally thank me for your profits but do not blame me for your losses because you are the one who pulled the trigger!!!

Thursday, November 4, 2010

VTRO - Q3 Earnings Released - Other stocks

CEO comments - "Q3 was a good quarter for Vertro. We met our expectation of double digit sequential quarterly revenue growth, achieved strong user growth both in English speaking countries as well as international markets, posted our fourth consecutive quarter of EBITDA profitability, and added cash to our balance sheet," commented Peter Corrao, Vertro's President and CEO.

Bottomline - It was not a mind blowing quarter and at the same time it really did not disappoint the market. They shown some sequential Quarter over Quarter grwoth in revenue and increased their cash balance to $7.1 million from $5.9 million. The increase was primarily a result of the increased revenue and net income in the quarter and the release of approximately $0.2 million of restricted cash.

What to do now? - I am still holding onto majority (3/4th) of my shares that I bought at $5.5 and $5 but sold 1/4th of my holdings at $5.35 this morning. This is a low float stock and could go either way. In my honest opinion, bears are going to knock it down to under $4 tomorrow, which I think would be a potential buy opportunity for bulls and I think once the dust settles down, they are going to take this stock much higher with all sorts of news items, buyout rumors etc...This is what happens with stocks of this nature. So keep an eye on VTRO.

MTSL - This stock had a nice run along with RITT today. MTSL is going to release its earnings on 11-11-2010 (corrected from 11/09). I emailed the company yesterday asking for the Q3 release date and a person by name Alon Maulem responded to my email. You can reach him at Alon.Mualem@mtsint.com. Here are the Q2 numbers, click here. MTSL out of losses and turned around the company towards profits and based on CEO's level of confidence, I am very positive that Q3 is going to be a great quarter and with a micro float of 400K shares in the market, this little one could be the next RITT. If the EPS improves along with the others market conditions, I am telling you shorts are going to get crushed like they got in RITT and TORM.

CEO's comments - "Our second quarter results were in line with our expectations for improved operating results. They reflect the focus we placed on improving our implementation processes while closely monitoring our overall costs," said Eytan Bar, CEO of MTSL.

Stocks to buy on a pull back - OINK, SLP, VTRO, MTSL, RITT, ICH, TORM (keep an eye on this stock, this has a potential to double!!!) and same with AERL - currently at $8.40 and TNAV - currently trading at $7.15

Disclosure - I do not have any positions in TORM, AERL, and TNAV

GFC Warrrants - I alerted about GFC warrants (TD Ameritrade - GFC+, Yahoo Finance- GFC-WT) on 10/17 when they were trading at .19, click here for historical prices and today they closed at .31. It was up 63% since my alert. I have been holding it since last year and my average price is .17. Looking at the trading pattern and volume of these warrants in the last few sessions, I think something big is going to happen with this company. I do not know what it is but I think warrants are going to double and triple from here. Also keep an eye on ARR warrants (ARR+ or ARR-WT)

That's it for tonight, good night guys!

A general Caution and Advise -As I always advise in my posts, Do not chase stocks. please keep in mind that I am not a Stock Market Analyst or an Investment Adviser to count on my recommendations/alerts. As always please do your DD before investing or speculating, start with a small position, always keep your stop losses in place and emotions out. Finally thank me for your profits but do not blame me for your losses because you are the one who pulled the trigger!!!

RITT, OINK at 52 Week high! MTSL...

RITT was alerted at $4.50 on 10/05. now it is trading at $8.35

OINK was alerted at $3.90 on 09,29, now it is trading at $7.50

Read Motely Fool bullish article on JTX

MTSL could be the next RITT

Good luck guys

A general Caution and Advise -As I always advise in my posts, Do not chase stocks. please keep in mind that I am not a Stock Market Analyst or an Investment Adviser to count on my recommendations/alerts. As always please do your DD before investing or speculating, start with a small position, always keep your stop losses in place and emotions out. Finally thank me for your profits but do not blame me for your losses because you are the one who pulled the trigger!!!

Wednesday, November 3, 2010

JTX - Breakout play

- I just bought some JTX at $1.04 as a breakout play. Expecting $1.20

- Added some VTRO at $5

- Added some MTSL at $1.80

- Closed 73 GS Nov 5th $160 puts at $1.10 (these were bought at $.80). Markets seem to be weak as expected so bought 30 of the same puts again at $1.11. Waiting for Fed QE2. If market rallies, I will take a small loss and close the otherwise I will let them ride.

A general Caution and Advise -As I always advise in my posts, Do not chase stocks. please keep in mind that I am not a Stock Market Analyst or an Investment Adviser to count on my recommendations/alerts. As always please do your DD before investing or speculating, start with a small position, always keep your stop losses in place and emotions out. Finally thank me for your profits but do not blame me for your losses because you are the one who pulled the trigger!!!

Tuesday, November 2, 2010

My pigs are on steroids today. lol OINK

My take on OINK - I sold a small chunk at $6.90 and will release the remaining as the price appreciates. Don't chase but buy on pull back.

I closed my GS December 18 2010 $170.0 at $2.70, it was a breakeven trade. I am expecting markets to drift down after the election results and before FOMC meeting. I think markets might not like if Fed's QE is <= $500 billion, which will pull the markets down. Buy the rumor Sell the News. I may be wrong but I may be correct also, who knows? so I bought some GS Nov 05 2010 $160 puts at .80

Monday, November 1, 2010

My newest pick is VTRO

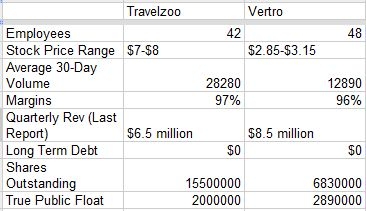

Vertro (Nasdaq: VTRO) is a small company that appears to be benefiting from a nascent "buy the stock / use the service" movement, much like the message board-driven movement that began with Travelzoo shareholders in 2004. The similarities between Travelzoo in March of 2004 and Vertro in October of 2010 are striking:

There is a very good article on VTRO on seeking alpha, click here to read the analysis

My take on VTRO - I have been having this stock on my watchlist for the last few days but I did not pay much attention thinking that it was just a "toolbar" stock and why should I buy when there are better players like Yahoo and Google but after reading the article I thought it is worth adding to portfolio. The stock gapped up this morning after the above article was posted on seeking alpha and hit $6 but I did not chase it but rather waited for a pull back. It dropped to $5 but I was away from my computer that time. I saw some frenzy buying during the close and add a small quantity at $5.50. This will surely be a good stock for momentum players. Also it is going to release its 3Q earnings on 11/04 so I hope you all will make use of the trend. The article has some interesting facts and obviously some pumping also so use your judgment before taking any action.

Other stocks -

- GAGA's website

- Closed GS $160 puts between $1.60 and $1.70 for a 52% profit margin! Isn't sweet to make that much in a few hours? I bought them at $1.10 as disclosed in my previous blog.

- Bought December GS $18 2010 170.0 Call again at $2.60 after I closed the puts. I hope market rallies tomorrow otherwise I will manage the contracts accordingly.

- Added some more MTSL at $2. I still do not think it's over yet.

Bought GAGA...Not Lady GAGA!

The Company currently operates 16 farms with an aggregate area of 1,257 hectares in the Chinese provinces of Fujian, Guangdong and Hebei. The Company produces and sells high quality vegetables all-year-round leveraging its large-scale greenhouses, proprietary horticultural know-how and comprehensive database.

http://finance.yahoo.com/news/Le-Gaga-Holdings-Limited-pz-1411701810.html?x=0&.v=1

I took a small position at $10 and might add more on a pull back.

OINK - is struggling to move despite excellent move by Chinese stock market yesterday but I am positive on my pigs. lol

GS Calls and Puts - I closed the December $170 strike price calls at $2.75 this morning for a nice profit. So far it looks like markets might pull back by the end of the day so bought some GS November $160 puts at $1.10. I will close them quickly and go long if I think my prediction is wrong but so far doing fine :)

Good luck guys!

A general Caution and Advise -As I always advise in my posts, Do not chase stocks. please keep in mind that I am not a Stock Market Analyst or an Investment Adviser to count on my recommendations/alerts. As always please do your DD before investing or speculating, start with a small position, always keep your stop losses in place and emotions out. Finally thank me for your profits but do not blame me for your losses because you are the one who pulled the trigger!!!

Blog Archive

-

▼

2010

(61)

-

▼

November

(15)

- TSRID - Just came up on my screen

- RITT hit all time high in Pre Market!

- My new Uranium pick - URG

- New picks are here - TIII MITK.OB MTNX

- Great Numbers from OINK!

- MTSL - Not an impressive quarter

- WXCO Earnings - Stock up

- Let's get some Uranium - Huge upside ahead

- AMOT - Multibagger

- VTRO - Q3 Earnings Released - Other stocks

- RITT, OINK at 52 Week high! MTSL...

- JTX - Breakout play

- My pigs are on steroids today. lol OINK

- My newest pick is VTRO

- Bought GAGA...Not Lady GAGA!

-

▼

November

(15)

Who is Mr.Incredible?

- Mr.Incredible

- New Jersey, United States

- Mr.Incredible is a Momentum/Technical Breakout player who trades small/micro cap plays and who saw a 600% Growth since 2006, Yes even in this down market. I am going to post my real trades (including profits/losses) soon...As a general caution and advice Please start with a small position and always keep your stop losses in place just in case....As usual Do your DD before investing. Thank me for your profits and don't blame me for your losses because you are the one who pulled the trigger!!!